Learn who we like to work with

Our Portfolio

Diversified

Portfolio

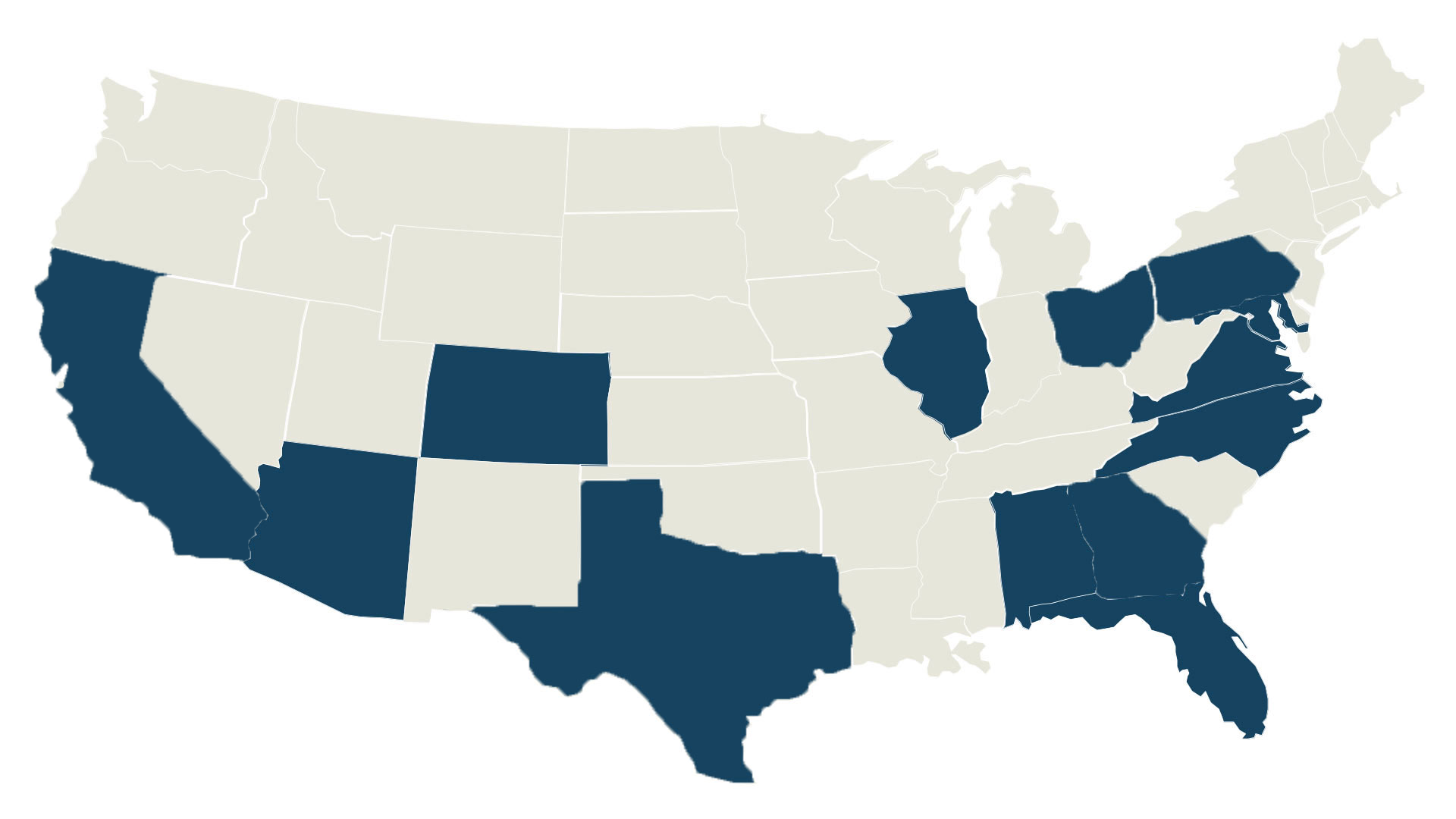

GIP acquires and manages a diversified portfolio of high quality single tenant properties with a generational outlook in mind. We are continuously looking to add assets to grow our portfolio in keeping with the caliber of tenants already occupying out buildings.

Including retail, office and industrial spaces.

View Our Portfolio

WASHINGTON, DC

RETAIL

Purchase Price: $2,480,000

Square Footage: 3,000

Credit Rating: AA-

ROCKFORD, IL

RETAIL

Purchase Price: $4,525,000

Square Footage: 15,288

Credit Rating: NR

TAMPA, FL

Retail UPREIT

Contribution Consideration: $2,200,000

Square Footage: 2,642

Credit Rating: BBB+

TAMPA, FL

RETAIL

Purchase Price: $3,475,000

Square Footage: 2,200

Credit Rating: BBB+

NORFOLK, VA

Retail UPREIT

Contribution Consideration: $7,100,000

Square Footage: 34,847

Credit Rating: BB+

SANTA MARIA, CA

RETAIL

Purchase Price: $6,081,037

Square Footage: 14,490

S&P Rating: BBB

TAMPA, FL

Retail UPREIT

Contribution Consideration: $1,780,000

Square Footage: 3,500

Credit Rating: BBB

SAN ANTONIO, TX

RETAIL EDUCATION

Purchase Price: $12,888,169

Square Footage: 12,888,169

S&P Rating: AAA

CHICAGO, IL

MEDICAL

Purchase Price: $3,100,000

Square Footage: 10,947

Credit Rating: BBB-

GRAND JUNCTION, CO

RETAIL

Purchase Price: $4,700,000

Square Footage: 30,751

Credit Rating: BBB

TUCSON, AZ

RETAIL

Purchase Price: $7,300,000

Square Footage: 88,404

Credit Rating: BBB-

HUNTSVILLE, AL

INDUSTRIAL

Purchase Price: $8,308,000

Square Footage: 59,091

Credit Rating: BBB+

MORROW, GA

RETAIL

Purchase Price: $1,293,355

Square Footage: 9,026

S&P Rating: BBB

BIG SPRING, TX

RETAIL

Purchase Price: $1,270,665

Square Footage: 9,026

S&P Rating: BBB

CASTAILA, OH

RETAIL

Purchase Price: $1,111,831

Square Footage: 9,026

S&P Rating: BBB

WILTON, ME

RETAIL

Purchase Price: $1,452,188

Square Footage: 9,100

S&P Rating: BBB

LAKESIDE, ME

RETAIL

Purchase Price: $1,134,522

Square Footage: 9,026

S&P Rating: BBB

MOUNT GILEAD, OH

RETAIL

Purchase Price: $1,066,451

Square Footage: 9,026

S&P Rating: BBB

LITCHFIELD, OH

RETAIL

Purchase Price: $1,247,974

Square Footage: 9,026

S&P Rating: BBB

THOMPSONTOWN, PA

RETAIL

Purchase Price: $1,111,831

Square Footage: 9,100

S&P Rating: BBB

BAKERSFIELD, CA

RETAIL

Purchase Price: $4,855,754

Square Footage: 18,827

S&P Rating: BBB

PLANT CITY, FL

OFFICE

Purchase Price: $1,700,000

Square Footage: 7,826

Credit Rating: BBB-

MAITLAND, FL

OFFICE

Purchase Price: $5,899,514

Square Footage: 33,118

S&P Rating: N/A

VACAVILLE, CA

OFFICE

Purchase Price: $

Square Footage: 11,014

S&P Rating: AA+

NORFOLK, VA

SHARED Office UPREIT

COMBINED Contribution Consideration: $11,800,000

Square Footage: 72,149

Credit Rating: AA-

MANTEO, NC

Office

Purchase Price: $1,700,000

Square Footage: 7,543

Credit Rating: AA

Interested in joining GIPR?

Looking To Sell?

GIPR acquires, owns, and manages a diversified portfolio of single-tenant net lease retail properties with high-credit-quality tenants across the United States. If you’re interested in Generational Income Properties, please reach out to our Acquisitions Manager, Robert Rohrlack III by filling out the form below. He will be in touch shortly.